|

Sales: 020 8295 0999 | Lettings: 020 8315 7690 | Park Lane Associated Office: 020 7318 7068

Sales: 020 8295 0999 | Lettings: 020 8315 7690 | Park Lane Associated Office: 020 7318 7068

Upcoming Changes to Land Transaction Tax Rates in Wales

As of 1 July 2021, there will be changes to Land Transaction Tax (LTT) in Wales. Up until 30 June 2021, LTT is payable when you purchase or lease a property above the threshold of £250,000. Therefore, currently, no tax is payable on the first £250,000 of a property. LTT is 5% on properties up to £400,000, 7.5% up to £750,000, 10% up to £1,500,000 with any amount thereafter taxed at 12%. However, this is due to change in a few months’ time.

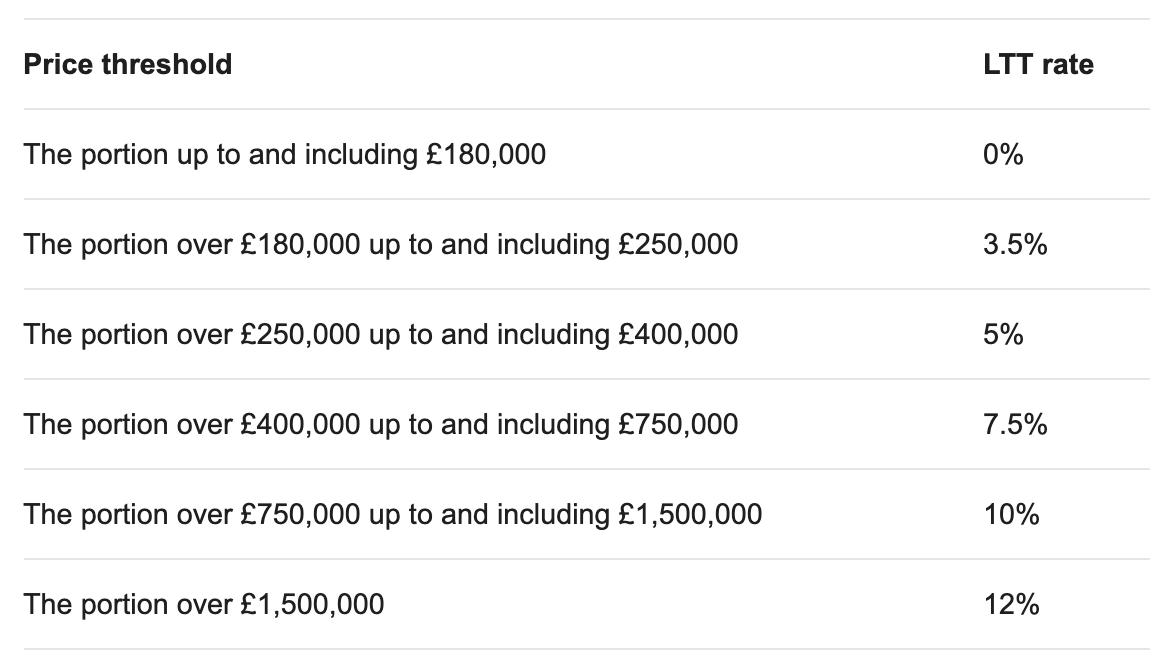

Transactions with an effective date on or after 1 July 2021

As of 1 July 2021, the LTT paid on a property will revert back to the residential tax rates prior to the temporary changes implemented in July 2020.

When you buy a residential property (freehold or leasehold) you will be required to pay 3.5% LTT on properties between the value of £180,001 and £250,000, 5% on properties between £250,001 and £400,000, 7.5% on properties between £400,001 and £750,000, 10% on those between £750,001 and £1,500,000, with any amount thereafter taxed at 12%. However, if you purchase a property for up to and including £180,000, no LTT is to be paid.

Visit gov.wales for more information

Contact us

Are you looking to move home in the near future? Contact your local Guild Member to begin your journey with a trusted local agent.

Summer 2025 UK Property Market Report: Renewed activity

Regional Property Market Update Summer 2025: Wales

Regional Property Market Update Summer 2025: Scotland

Regional Property Market Update Summer 2025: Northern Ireland

Contact us

About us

Humphriss & Ryde is an independent estate agent with offices in Chislehurst.

"You absolutely delivered what you said you would. The service was very professional and you gave excellent advice when it was needed. You were always very responsive and genuinely seemed to care and want to make things happen for us." Mr B, Chislehurst